|

Reverse Mortgage as a concept is well known to mortgage professionals

in Indian retail financial services market. The product has been in existence

in some of the western markets for more than three decades. In India, the

product was introduced in financial budget presented in 2007-08 by then Finance

Minister Shri. P. Chidambaram with a vision to bring smile to the elders of the

society. In a country devoid of any

social security, this product is well thought out for Senior Citizens enabling

them to release the equity of their self-acquired and owned residential

property.

The product “Reverse Mortgage” in simple terms is

unlocking the value of a self-owned residential property with a major

difference being that the individual availing this product can get lump sum funds or periodic payments or

combination of both unlike the need to repay

periodic installments when you avail a home loan or home equity loan. Thought

behind this product is that a senior citizen can supplement his/her income and

continue to stay in the property till his/her death or the death of the spouse.

The loan amount availed gets settled by sale of the property by the financial

institution and any amount received excess of the outstanding loan amount is

given to the legal heirs. The customer can foreclose at any point of time

during the loan tenor and release the mortgage.

In this human saga of survival on this earth,

this product innovation can help elderly members of the society to live with

dignity, respect and honor. The government’s world over are increasingly

finding difficult to manage their scarce resources in social security programs.

Adding to the pressure of the national budgets of developing & developed

economies, the social fabric of the community is also being tested. Now the

concept of joint families and supporting parents in their old age is giving way

to nuclear families and old age homes. Increasingly, it is seen that elderly

parents are living all alone fending for themselves emotionally and financially.

It may be essential to make some of the readers coming

to this page of the blog to understand the concept with an example. Let us say,

Mrs. & Mr. Kryo wants to purchase a new home or home on resale by availing

housing loan from a bank or mortgage finance institution. Based on the property

cost, their credit history and norms of the institution they would avail a loan

for tenor of say 15-20 years probably at fixed or variable rate. In this

scenario they would be paying monthly installment for the next 20 years or till

they foreclose the loan. Typically we may also call it as forward mortgage. If the same couple after foreclosure wishes to avail a

loan against the market value of the property, the financial institution would

probably extend Home Equity Loan based on the property value

and credit history of the customer. The couple would be repaying the loan as

per the periodic installment for the tenor availed.

Now, interestingly the same couple at the age of 60+

approaches for a loan with no income source can still avail a reverse mortgage

wherein instead of repaying periodic installments, the mortgage finance

institution would extend funds as a line of credit or lump sum payment or

periodic annuity payment for a fixed tenor or for life time. This sounds good

when you look at the life cycle of the property it undergoes in tandem with

life cycle of the owner of the property complementing each other as a true

companion.

Scenario in Developed

Economies:

The product was formally institutionalized around 1960

in USA and it has been reasonably well accepted in UK, Canada and Australia

only in the last two decades. In USA, the government’s federal housing

administration’s backed project Home Equity Conversion Mortgage (HECM) is

popular and the entire product is probably 1% of the total mortgage market.

It has taken almost two decades for this product to

get reasonable response. The reasons are not very different in each of the

markets. It all starts with consumer education and acceptance. The reasons

largely noted are fear of not losing roof over head to emotional attachment to

property and desire to leave behind the property for children. From the lending

institutions perspective the product has number of risks associated and it

needs government support in terms of funding considering the long term nature

of the product.

Indian Context

The product has been in existence only for the last

five years. In terms of the product life cycle it is still in infancy stage in

India.

It is quite appreciable that within five

years the National Housing Bank (NHB) has

played a pivotal role in shaping the product from various legal and taxation

perspective to get it presented in the parliament. The effort of NHB needs

accolades as within these five years the basic version of the product was

introduced for tenor of 20 years and now it has promoted Reverse Mortgage loan enabled Annuity(RMLeA) in joint association with

Star Union Daichi Life Insurance Company and banks i.e, Union Bank &

Central Bank. Since 2008, NHB has conducted more than 55 seminars educating

and promoting this product across the country amongst the target group and also

counseling centers are operational in joint association with Helpage India in multiple locations.

The last count indicated that nearly 25 banks have

been promoting this product in India. The Press Trust of India carried news on May

21, 2010 stating that nearly 7000 RMLeA amounting to Rs.1400 Cr were sanctioned

by various prime lending institutions in India. The Indian Express newspaper

dated Nov 26, 2011 carried an article stating that only handful of 150

customers have availed out of 80 million population of senior citizens in this

country. The purpose to quote the above news is only to bring home a point that

such products will take its own due course for acceptance and it is good to

take small steps in the progress.

For a

detailed understanding of the operational guidelines issued by NHB, one can

click on the link given here http://nhb.org.in/RML/RML_Index.php

Opportunities & Challenges for Reverse Mortgage in Indian

Market

The opportunities for Reverse Mortgage s is bound to grow

in coming years with awareness and education by multiple institutions. Let us

look at the population distribution and population projection as per Indian

Census figures.

Table -1:

PROJECTED POPULATION 2001-2016

|

PROJECTED POPULATION (,000)

|

|

Age

|

2001

|

2006

|

2011

|

2016

|

|

group

|

Persons

|

%

|

Persons

|

%

|

Persons

|

%

|

Persons

|

%

|

|

0-4

|

121395

|

11.8

|

115239

|

10.36

|

114878

|

9.63

|

114101

|

8.99

|

|

5-9

|

123311

|

11.99

|

119290

|

10.73

|

113486

|

9.52

|

113309

|

8.93

|

|

10-14

|

119876

|

11.65

|

122469

|

11.01

|

118577

|

9.94

|

112880

|

8.9

|

|

15-19

|

104038

|

10.11

|

119056

|

10.7

|

121727

|

10.21

|

117928

|

9.29

|

|

20-24

|

91034

|

8.85

|

103048

|

9.27

|

118038

|

9.9

|

120774

|

9.52

|

|

25-29

|

82941

|

8.06

|

89963

|

8.09

|

101956

|

8.55

|

116887

|

9.21

|

|

30-34

|

75838

|

7.37

|

81858

|

7.36

|

88905

|

7.46

|

100854

|

7.95

|

|

35-39

|

67971

|

6.61

|

74700

|

6.72

|

80759

|

6.77

|

87811

|

6.92

|

|

40-44

|

57518

|

5.59

|

66711

|

6

|

73464

|

6.16

|

79536

|

6.27

|

|

45-49

|

46911

|

4.56

|

56073

|

5.04

|

65211

|

5.47

|

71954

|

5.67

|

|

50-54

|

37159

|

3.61

|

45169

|

4.06

|

54195

|

4.54

|

63204

|

4.98

|

|

55-59

|

29933

|

2.91

|

35032

|

3.15

|

42837

|

3.59

|

51624

|

4.07

|

|

60-64

|

25691

|

2.5

|

27442

|

2.47

|

32405

|

2.72

|

39886

|

3.14

|

|

65-69

|

20514

|

1.99

|

22506

|

2.02

|

24397

|

2.05

|

29097

|

2.29

|

|

70-74

|

15996

|

1.56

|

16860

|

1.52

|

18943

|

1.59

|

20851

|

1.64

|

|

75-79

|

5308

|

0.52

|

12011

|

1.08

|

13092

|

1.1

|

15025

|

1.18

|

|

80+

|

3176

|

0.31

|

4761

|

0.43

|

9633

|

0.81

|

13238

|

1.04

|

|

Total

|

1028610

|

100

|

1112188

|

100

|

1192503

|

100

|

1268959

|

100

|

|

Source:

MOSPI - Office of Registrar General of India, Ministry of Home Affairs.

|

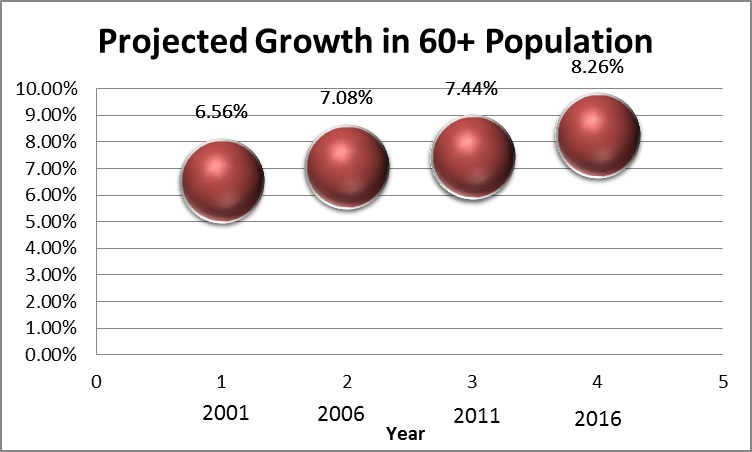

Interesting Fact:

1. You will observe that India is very

young country with more than 45% of its population projected to be below 25

years even in 2016. At the same time the

target segment for reverse mortgage i.e, 60+ is gradually growing from 6.567%

in 2001 to 8.26% in 2016.

It

is an opportunity even from risk perspective for every player including the

government to learn and perfect this product as the growing population ages

with grace.

2. For availing reverse mortgage the

senior citizen should have primarily self-acquired residential property with no

encumbrances. It would not be possible to avail on ancestral property as the

ownership has to be passed on to the legal heirs.

Secondly,

home ownership has registered steep growth only from early 2000. Please find

the status of home ownership and condition of houses shown in the Table –II A

& B given below. We have identified only two important factors i.,e houses

having concrete roof and households having bank accounts as parameter to filter

the customer segment that possibly may avail Reverse Mortgage. It looks like

that segment may not be more than 70 - 90 million as of today considering

initial acceptance in urban pockets.

Even

addressing 10% of this segment every year would mean a large pie of 7 to 9

million customers to be catered. If the

reverse mortgage loan size is just Rs.20 lacs, we are talking in terms of

trillions. A comparison with housing demand of 24.7 million units puts this

figure at 28% to 37% of new homes. This segment will only increase.

Table – II-A:

Houses,

Household Amenities and Assets

|

House list Item

|

Absolute number

|

Percentage

|

|

Total

|

Rural

|

Urban

|

Total

|

Rural

|

Urban

|

|

Total

households

|

246,692,667

|

167,826,730

|

78,865,937

|

100.0

|

100.0

|

100.0

|

|

Good

|

131,019,820

|

77,041,343

|

53,978,477

|

53.1

|

45.9

|

68.4

|

|

Livable

|

102,470,426

|

79,855,814

|

22,614,612

|

41.5

|

47.6

|

28.7

|

|

Dilapidated

|

13,202,421

|

10,929,573

|

2,272,848

|

5.4

|

6.5

|

2.9

|

Table – II-B:

Houses,

Household Amenities and Assets

|

|

Absolute number

|

Percentage

|

|

Households

by ownership status

|

Total

|

Rural

|

Urban

|

Total

|

Rural

|

Urban

|

|

Total

number of households

|

246,692,667

|

167,826,730

|

78,865,937

|

100.0

|

100.0

|

100.0

|

|

Owned

|

213,526,283

|

158,983,956

|

54,542,327

|

86.6

|

94.7

|

69.2

|

|

Rented

|

27,368,304

|

5,644,581

|

21,723,723

|

11.1

|

3.4

|

27.5

|

|

Others

|

5,798,080

|

3,198,193

|

2,599,887

|

2.4

|

1.9

|

3.3

|

|

Households

by Predominant material of roof

|

|

Concrete

|

71,659,299

|

30,746,938

|

40912361

|

29

|

18.3

|

51.9

|

|

Households

availing banking services

|

144,814,788

|

91,369,805

|

53,444,983

|

58.7

|

54.4

|

67.8

|

|

Source: Census

of India 2011 : Houses, Household Amenities and Assets

|

3. It is important work on this product

and perfect the mechanism as the generation that will flowing in to this segment

would rise with government expecting people to do their own retirement planning

with life time pension even for government servants being out of question. I

think it is perfect case for banks, HFCs, Insurance companies, PFRDA along with

the government and NHB to create a road map for synergy

4.There

are two ways to look at the Life Expectancy Table –III shown below.

It really indicates that it

is a rising trend with better medical facilities. However, the medical

facilities would come with a cost requiring more investment into medical care

and also expenses for basic living which the population will face as they age

with depleting resources.

On the other hand from the

risk perspective this throws a challenge for the lenders as the portfolio may

have adverse age group. The property would be available only after the death of

the joint owning spouse which may end up having negative equity and there is no

recourse to recovery other than the property.

Table: III

Projected Values of Expectation of Life at Birth

|

Sr. No.

|

Indices (Expectation of Life at Birth)

|

2001-05

|

2006-10

|

2011-15

|

2016-20

|

2021-25

|

|

1.

|

Male

|

63.8

|

65.8

|

67.3

|

68.8

|

69.8

|

|

Female

|

66.1

|

68.1

|

69.6

|

71.1

|

72.3

|

|

2.

|

Projected

Population

|

1112.2

(2006)

|

1192.5

(2011)

|

1269.0

(2016)

|

1339.7

(2021)

|

1399.8

(2026)

|

- Census

India, Population Projection

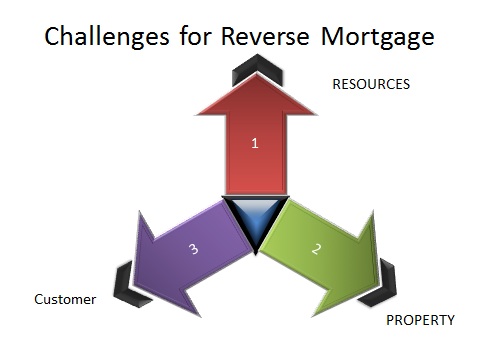

Challenges

There are three challenges in this product segment

1. Resources:

While it is becoming increasingly difficult to raise long term resources for

mortgage finance institutions for new home loans, one may wonder how they would

address for the reverse mortgage product where the interest accrued as income

may be realizable only after 10 to 15 years.

That

actually brings to a question as how the accounting is being done and what are

the tax implications for such mortgage finance or banking institutions on

income shown in its books. One should also consider the regulatory norms for

provisioning and capital allocation in this product segment.

2. Property:

Considering the quality of present day construction it is possible that age of

the property may be substantially reduced at the time of valuation reducing the

customer’s eligibility. At the same time from the institutional perspective it

is essential to do so to avoid market risk on the realizable property value.

Today,

we really need to usher in the building construction codes in true sense so

that an individual in old age is able to release sufficient equity in the

property

3. Customer:

From the customer perspective it is essential to have extensive educational

programs. However, the seminars should include the family members of Senior

Citizens to set the fears to rest and be good influencers in this product

segment. Taking a leaf from the adage “catch them young”, we probably need to

address the segment while at 55+. We will definitely find more innovation in

communication as we go ahead.

The

community programs have to be sustained to penetrate 10% of the population in

the target segment.

Further,

from the income tax perspective there is an anomaly in the treatment of annuity

received through an insurance company and if the same is received as lump sum

amount or periodic payments from a lending institution. The same has been

reproduced here(Source: NHB Website).

1. All payments under reverse mortgage

loan are exempt from income tax under Section 10(43) of the Income-tax Act,

1961. However, periodic annuity payments are subject to tax under Section 17,

56 and 80CCC of the Income Tax Act and taxable in the hands of the annuity

recipients.

2. Section 10 of the Income tax Act,

1961 has been amended to provide that any amount received by an individual as a

loan, either in lump-sum or in installment, in a transaction of reverse

mortgage referred to in clause (xvi) of Section 47 of the Income-tax act shall

not be included in total income.

We

believe that there is a big market waiting to be tapped and the players would

have done their homework. As consultants in the mortgage financial sector we

look forward to be of assistance to institutions in promoting this product.

As industry professional, we feel further research

from the perspective of all the stakeholders can be done. We look forward to partner with any Institution or individual to conduct further research or if some work is in

progress we would be more than glad to be associated with the project.

We

look forward to your response and valuable comments. You can look forward to

more articles on Reverse Mortgage on this blog in the days to come

|